Whisky investor account examples

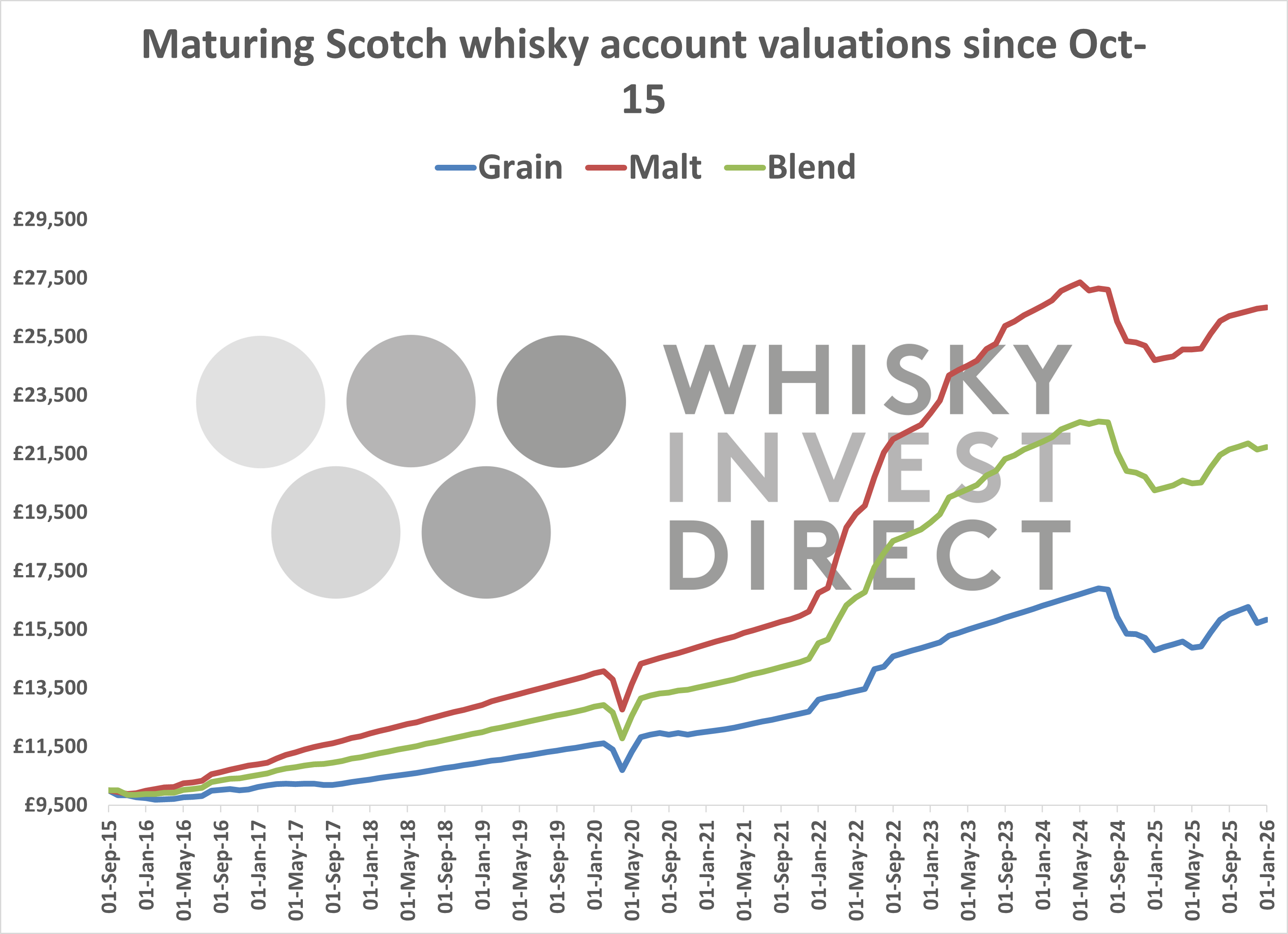

How has maturing whisky performed since October 2015?

The profit and loss examples below are from real accounts opened and funded in October 2015. The volume of maturing whisky purchased in each account was calculated to leave sufficient cash to pay all storage and insurance fees for 10 years.

£10,000 was deposited into each account and the required volumes of the maturing malt and grain whisky available at that time were purchased.

When we receive a bulk trade bid for a whisky owned by these example accounts our policy is to accept the bid and then use the proceeds from the sale to buy the same volume of a suitable whisky within a reasonable timescale.

These accounts can be found and scrutinised in our Audit under the following public facing nick names:

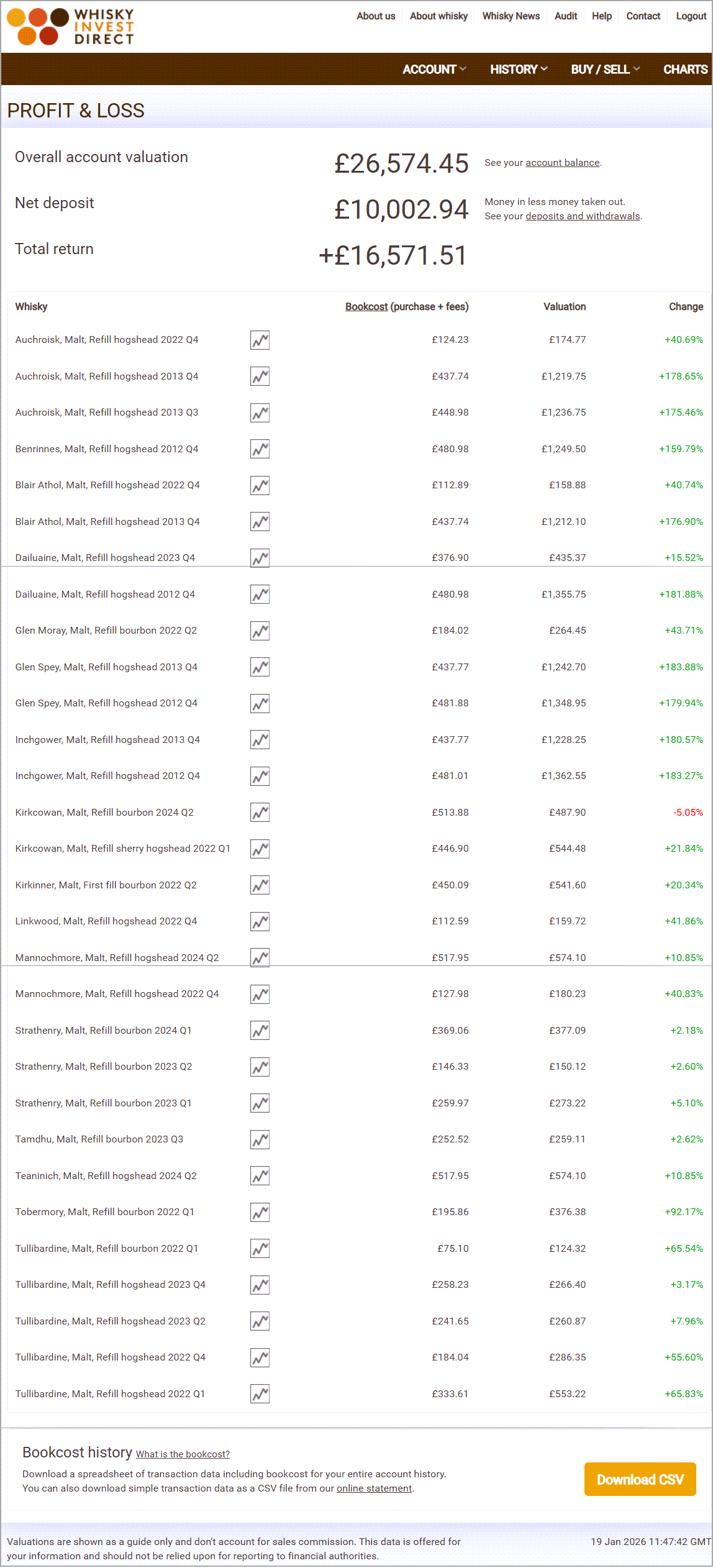

WIDMALT – 100% Malt – 85 LPA of each of the 24 malt whiskies then available

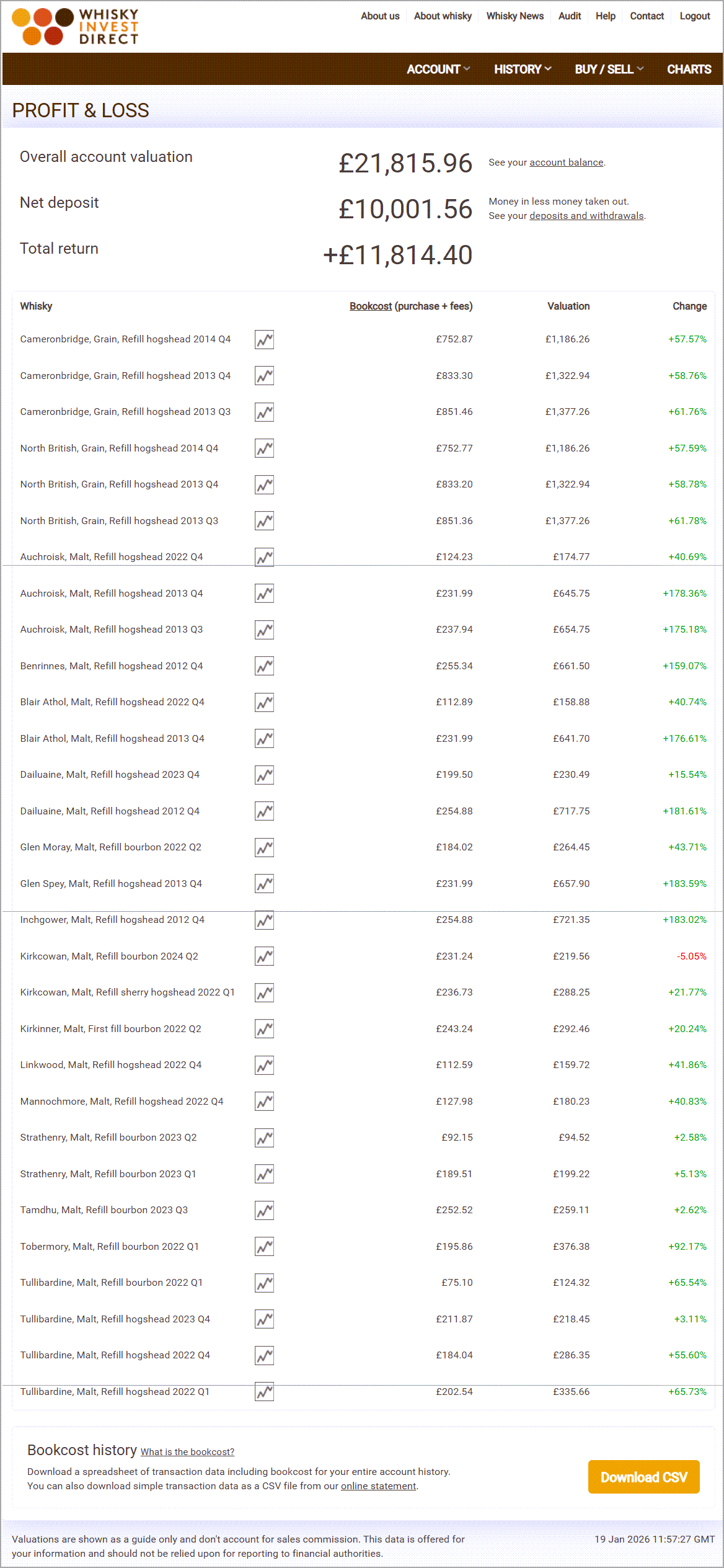

WIDBLENDED – 60% Grain & 40% Malt – 255 LPA of each grain and 45 LPA of each malt then available

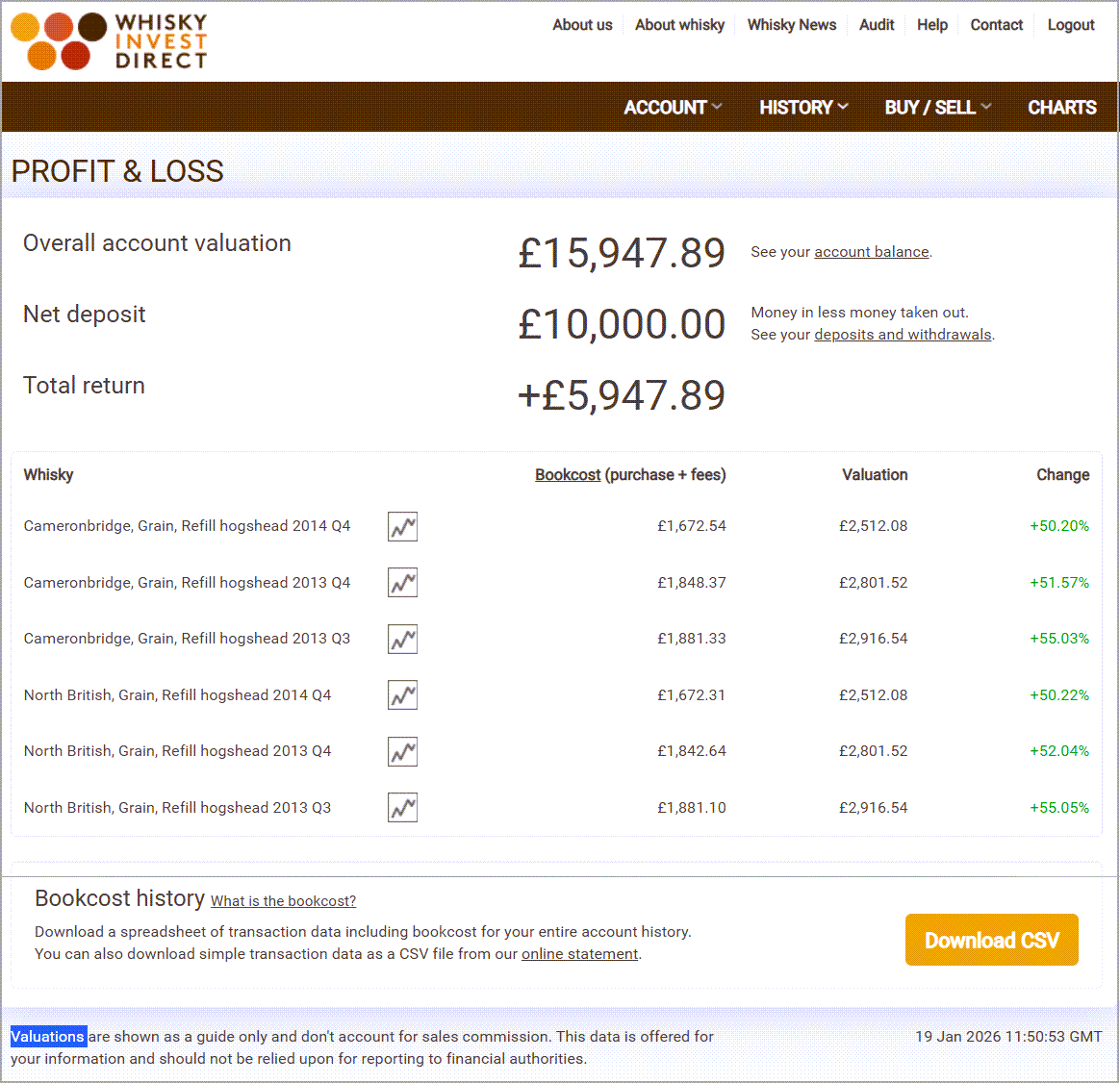

WIDGRAIN - 100% Grain – 540 LPA of each of the 6 grain whiskies then available

Note that these example accounts withheld enough funds from the initial £10,000 deposit to pay future storage fees for approximately 10 years. Now that 10 years have passed since their creation, the accounts fund the cost of storage via the sale of whisky.

The table below reflects the gains made on the investment in maturing Scotch to date, but it is worth noting that where sales have been made, the proceeds have not been withdrawn from the account, so the investment is less efficient than if the profits had been reinvested, here or elsewhere. (Last updated 19 January 2026)

To pay their ongoing storage fees, our users tend to make small deposits once every couple of months, rather than leaving idle money in their accounts for long periods of time.

For illustrations of the commission fees and storage charges to invest in maturing Scotch whisky see the worked examples and note that for every maturing malt and grain whisky available on the live orderboard there is a chart showing its price history.

Of course, past performance doesn't guarantee future returns but the images below show the most recent profit and loss screengrab from each account and also shows the % change in value of each distinct whisky line.

WIDMALT - Malt whisky account

WIDBLENDED - Blended whisky account

WIDGRAIN - Grain whisky account

This page provides only general information. It does not consider your personal situation or needs. You are entitled to rely on the truth of the historic data above, but you cannot rely on any forward projections stated or implied. Previous price trends are no guarantee of future movements. Whisky, a physical commodity, is not an investment within the terms and scope of the Financial Services and Markets Act 2000. Your protection is limited to the resale value of the whisky you own, together with normal insurance covering specified risks including fire and theft. You will not be protected by the Financial Services Compensation Scheme, and you may not fully recover your initial investment. Investing in whisky may involve risks which you are currently unaware of. If you are not able to assess this information, seek expert investment advice.