Whisky Investment Returns

Is Whisky A Good Investment?

Achieving a positive return is front of mind for any investor, and whisky investment returns are no different. Strong Whisky investment returns were once the reserve of distilleries and blenders, but with a platform like WhiskyInvestDirect, the retail investor can now gain exposure to the market.

Striking the balance between risk and return is essential when it comes to whisky. But there are a series of reasons to invest including the fact it is VAT free (whilst it remains in a bond), supports a major British industry and has achieved strong market returns historically over the last 10+ years.

When deciding on whether or not whisky is a good investment, it is important to understand some of the risks involved. There is always the chance that the market price of the whisky might fall and the product may become difficult to sell if it becomes too old or less valuable if it becomes a minor line. The above is important to consider when you are deciding if investing in whisky is a good idea.

Are Whisky Casks A Good Investment?

Taking a step back and looking at some of the benefits of whisky investment reveals an attractive proposition. You gain exposure to an asset class and potential returns that move separately from traditional markets.

Whisky is unlike most commodities in that it improves and increases in value as it ages, but only while it's still in the cask. This is a key factor when comparing bottled whisky investments to cask whisky investments. This strengthens the case for investing in casked whisky. You also gain access to the market before the retail mark-ups that occur with bottling and when you invest through WhiskyInvestDirect, you benefit from low storage fees and complete flexibility on when you sell the investment.

It is worth noting that for many the choice is binary between buying a whisky cask as an investment and buying a bottle. Whilst the latter can provide some returns, the drawbacks of self-storage and the added risks associated with that can often make it difficult to justify. Equally, investing in casks provides a different layer of return as you are investing in the maturation of the whisky, but storage is perceived as difficult, and selling a single cask can cause problems, as most industry buyers are interested in larger volumes.

This is where WhiskyInvestDirect comes in, allowing you to get all of the benefits of whisky cask ownership without having to worry about storage, insurance, theft or any of the other variables. You can spread your investment across multiple lines, rather than relying on a single cask or bottle. And when you come to sell, your whisky is part of a larger batch, making it more attractive to the biggest buyers in the industry. Open an account to start your whisky investing journey today.

Investing through WhiskyInvestDirect also allows you to create a portfolio spread by investing in multiple whiskies across different ages, regions, distilleries and stock types. This creates a diversified portfolio and has the potential to mitigate risk and enhance returns.

When looking at the potential tax implications of whisky investment, one area that is often overlooked is the capital gains tax paid when selling the whisky and realising the investment. Generally, whisky is classed as a wasting asset as it has a lifespan of less than 50 years. This is good for investors looking to get the most value out of their capital. To confirm whether your investment qualifies, please consult a tax advisor.

What Is The Average Return on Whisky Investment?

We know that returns vary by asset class and often times increased risk comes with increased potential gains. Whisky returns reflect this, and give you access to a commodity that moves separately from the wider financial markets, meaning you can benefit from diversification by having non-correlating assets within your portfolio.

So what is the average return on a whisky investment?

The cash price for 8-year old Scotch whisky bought new, and sold each year of the decade 2015-2024 shows average historical returns of 11.7% per annum, net of all costs incurred on our platform.

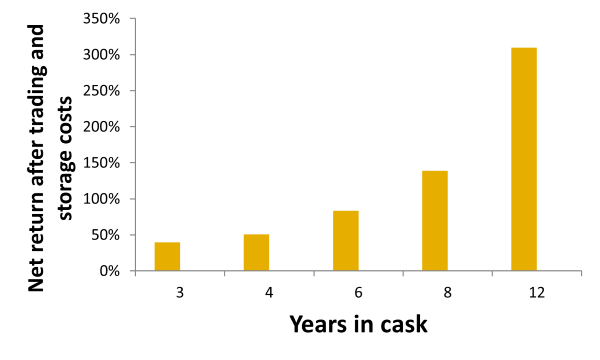

The rate of return increases as the whisky matures, as shown on the graph. Whilst prices can be volatile and results cannot be guaranteed, historically speaking, when getting into the market through WhiskyInvestDirect, retail investors have seen strong gains.

Always be wary of brokerages and websites offering you guaranteed and exceptionally high returns when you are determining if whisky is worth investing in. Whilst there are lots of reputable dealers out there, there are also a lot of scammers. Make sure you do your due diligence; if it looks too good to be true, it probably is.

What Can Impact Your Whisky Investment Return?

Different markets have their own unique variables that influence the average return rate, and whisky is no different. Several distinctive factors can impact the value of whisky as an investment, including:

- Stock Levels: When there is an oversupply of whisky in popular regions like Scotland or Japan, prices often soften. High stock levels can lead to market saturation, which may lower resale values and overall returns.

- Global Consumer Demand: Whisky values are heavily influenced by global interest. If consumer appetite for certain types (e.g. single malts or Japanese expressions) wanes, prices may drop. Economic downturns or shifting drinking habits can also cause demand to fall, directly impacting returns.

- Age at Point of Sale: The timing of your sale is critical. Whisky appreciates in value as it ages -within a cask, so the return on investment may be higher if you hold onto the asset for longer. However, there’s a point where the value may plateau or even dip depending on market trends.

Is Irish Whiskey a good investment?

Irish whiskey has experienced remarkable growth in popularity in recent years, with exports reaching €1 billion in 2024, a 13% increase from the previous year. This increase reflects its rising global popularity, particularly in markets such as the USA and Europe. Such trends have piqued the interest of investors seeking alternative assets with promising returns.

Some of the main Irish whiskey distilleries include Jameson Distillery Bow Street (Dublin), Midleton Distillery (Cork), and Bushmills Distillery (Antrim). Finding the right investment opportunity can be difficult with Irish whiskey, a more cost effective and reliable alternative is to invest in Scotch whisky through a platform like WhiskyInvestDirect.

WhiskyInvestDirect exclusively stocks Scotch Whiskies intended for blending. The Scotch whisky industry is the only one that actively trades with itself, with distilleries routinely sourcing spirits to fill gaps in their blending portfolios (via Bulk Trade Bids). This means all stock on the WhiskyInvestDirect platform is positioned to return to the trade, often to an industry buyer different from the original distiller. This is why expensive single malts like Macallan are not present on the platform, as they do not serve the trade-focused model. You are investing in the whisky process as opposed to the individual rarity of a given brand.

Should I Invest In Whisky?

Whether or not you should invest in whisky largely depends on your individual goals, risk tolerance, and interest in alternative investments. As with any asset class, it's important to consider your broader portfolio and how whisky fits into your long-term financial strategy.

There is always an opportunity cost, and any money that you put towards investing in whisky could, of course, be used elsewhere, be it in gold, stocks or bonds; factor this in when making your decision. Also, when looking at whether or not you should invest in Scotch whisky, keep the time frame in mind. If you are looking for a quick ‘investment’ opportunity of less than a year, it may not be right for you. If you are looking for a sensible, long-term investment of into the 3, 5 even 10 year mark, then the whisky market may be worth exploring.

If you are in a position where you are looking to diversify your portfolio through a respected, well-traded and highly in-demand commodity, then whisky could be for you. When it comes to cask investing, many will tell you that you need a large amount of upfront capital to purchase these casks. But WhiskyInvestDirect is changing this by making whisky investment accessible to smaller investors.

The 11.7% average returns driven compare favourably with other asset classes and help add an extra level of resilience to your portfolio. Equally, if you are passionate about Scotch whisky and want to support the industry, putting your capital to work here is a great thing to do. The above does not constitute financial advice, so you should always consult with a professional before making any changes to your financial management.

*The value of whisky can fluctuate, going down as well as up. Past performance is not a reliable indicator of future price movements. No content on the WhiskyInvestDirect website nor in any of its communications constitutes investment advice. It is recommended that you seek professional advice to assess whether investing in whisky aligns with your financial goals.