New World Malts

With the rise of malt whisky distilling around the world, single malts are no longer synonymous with Scotch. Some see it as a competitive threat to the industry, others as an opportunity to broaden the category for everyone's benefit. Ian Fraser follows the debate …

Just as New World wines came from virtually nowhere to shake up, and seize market share, from European wine producers from the 1980s onwards, could 'world whiskies' – single malts made in countries such as from India, Taiwan, Australia, New Zealand, France, Sweden, Wales and even England – entice drinkers away from Scotch, causing the sector to suffer loss of prestige and a loss of market share? It's a question worth asking, even if it sometimes seems to be a taboo subject in the Scotch whisky industry.

The historic turning point arguably came in 2010, when Fusion, a single malt from Bangalore-based Amrut Distilleries, was named as the world's third best whisky by Jim Murray in his annual 'Whisky Bible'. Murray described it as "one of the great whiskies found anywhere in the world." Amrut was followed by other impressive Indian single malts, such as Paul John (2012), Rampur (2016) and Indri (2021). Together with single malts from other non-traditional whisky producing regions, these are increasingly hoovering up international awards and gaining global presence.

Arthur Motley, who recently stepped down as managing director of Royal Mile Whiskies, says the success of world whiskies has brought about a shift in perceptions of Scotch. "In the 1980s, 1990s and early 2000s, the assumption was that there was something special about Scotland – whether it was the climate, the water, or the ingenuity of the people – which meant Scotch whisky could never, and would never, be matched in terms of quality."

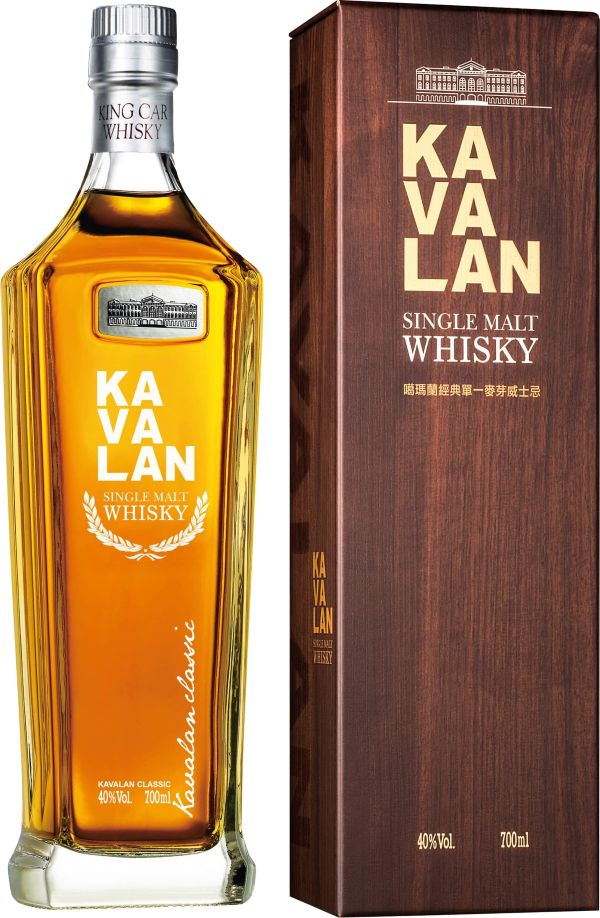

However Motley, also the amateur researcher and co-founder of YouTube channel Liquid Antiquarium, says that assumption was blown apart when, initially, Japanese single malts started winning international awards post Millennium. "Now, people are making great single malt whisky in Sweden – Smögen Whisky, which is small-scale – and Taiwan – Kavalan, which is very large-scale, as well as in lots of other places around the world. It's become obvious that great single malt whisky doesn't need to be from Scotland." He said, as a consequence, "Scotch's USP – that it is from Scotland – has been slightly degraded."

A common view in the industry is that, by attracting new drinkers to an enlarged whisky category, world whiskies will be a net positive for Scotch. Ian Macleod Distillers' managing director Leonard Russell says: "Of the total world whisky market, Scotch has lost some share, but I don't have a big problem with that, because if these local domestic whiskies are bringing consumers into the category, then it's of benefit to the whole industry. The growth of Prosecco and Cava hasn't hurt Champagne."

David Hume, director of Drinksmith Consulting and a former brand communications head at William Grant & Sons agrees, saying: "I believe the rise of international single malts can only be a good thing for the category as it offers consumers more choice. I don't really see [the rise of quality single malts made elsewhere] as a threat to the future of Scotch. The impact on Scotch is likely to vary by market – but the removal of trade barriers in different parts of the world, such as India, is likely to have a much bigger impact on the future health of Scotch."

However, others are more pessimistic. One practical consequence of the rise of quality 'world whisky' single malts is that Scottish ones end up being squeezed off retailers' shelves, especially in countries that have their own thriving single malts sector. As Isle of Harris Distillers managing director Simon Erlanger says: "Wine and spirits stockists' shelves are not made of elastic."

Simon Murphy, director of drinks consultancy Asian Alchemy, believes the rise of world whisky could cause a swing back to blends. "Well-informed single-malt consumers are being attracted to different and interesting [Japanese and new world whiskies]. There's no doubt it's a challenging time for Scotch. For NAS (non-age statement) new-release single malts, very high prices have intimidated single-malt drinkers and, in countries like China, the consumer will turn to blended Scotch, where price points aren't quite so challenging, and age statements are less expected."

Sukhinder Singh, co-founder and owner of Elixir Distillers, last year told me the big drinks firms are genuinely concerned. "Of course, the Scotch whisky distillers are scared. If they weren't, they wouldn't be buying and building distilleries around the world," he said, pointing to Diageo's investment in "craft" distilleries Starward (Australia), Westward (USA), Stauning (Denmark), Kanosuke (Japan), and Fielden (England) through its 'accelerator' Distill Ventures, as well as Diageo and Pernod Ricard's major investments in single-malt production in India and China.

Last November Diageo unveiled its £120m YunTuo malt distillery in Yunnan province, China with a 2m LPA (litres of pure alcohol) production capacity, where CEO Debra Crew says the ambition is to "create the highest-quality China-origin single malt whisky that will fire the imagination of whisky enthusiasts worldwide and place China firmly on the global whisky map."

Pernod is building its $200m Nagpur malt distillery and maturation complex in Maharashtra India which, with a capacity of 13m LPA, will be Asia's largest such distillery. The French firm has also invested $150m 1m LPA The Chuan malt distillery in Sichuan province, which Pernod Ricard Asia CEO Philippe Guettat says will "set new standards for single malt whisky." Surely Diageo and Pernod Ricard wouldn't be expanding in this way if they suspected it would cannibalise their existing Scotch whisky portfolios?

Motley detects real positives from whisky market evolutions, saying the rise of world whisky creates scope for Scotch distillers to "learn from the slightly different approaches being taken overseas" and benefit from a feedback loop.

"Another response would be to look at the legislation and whether Scotch whisky needs to be quite so rigid in terms of what you can and can't do. Other countries have looser legislation covering production, enabling them to create different flavours." It's an option Motley believes worthy of consideration, though he concedes it could put the "coherence" of the Scotch category at risk.

Ian Fraser is a financial journalist, a former business editor of Sunday Times Scotland, and author of Shredded: Inside RBS The Bank That Broke Britain.