Scotch for the Long Haul

Waiting in departures, clutching a bottle of duty-free Scotch is an enduring tradition. But while passenger numbers are up on 2019, the average spend is down. The high-rolling Chinese are sorely missed, but the Indians are coming, reports Tom Bruce-Gardyne …

Half way through the decade, it's clear these are not the roaring twenties, and products reliant on a discretionary spend like Scotch are suffering. Yet there is one market that has always been less affected by the mood on the High Street, and where shoppers behave differently - global travel retail (GTR) dubbed 'the last bastion of premiumisation'.

William Ovens prefers: "the leading global channel for the premiumisation of spirits." As head of GTR for Ian Macleod Distillers (IMD) whose malts include Glengoyne and Tamdhu, he says, "there's a heavier weighting to luxury sales in GTR, as can be seen by the number of channel exclusive SKUs (lines) and luxury stand-alone boutiques and 'shop in shops' in GTR."

Last year, duty-free spirits grew 6% in value and 5% in volume, compared to 0% in value and 2% in volume in domestic markets according to the IWSR which reported "a squeeze" in the core premium segment. "We're seeing a growing polarisation in spend, with travellers either trading up to prestige and prestige-plus tiers, or seeking strong value at standard and entry-level price points," said Charlotte Reid, the IWSR's senior insights manager for GTR.

.jpg)

Right now, William is not seeing much trading up in Scotch. "I think the upper end is also highly challenged. People are not spending as much on high value, luxury or fine & rare SKUs," he says. "There's no question about that; I hear it from multiple operators."

Even those who can afford to blow thousands on a bottle are feeling the pinch, and Macleod's has adjusted pricing accordingly. "We have a 31 year-old Rosebank in our remarkable cask releases for £1,900. Previously you could only buy into Rosebank by spending £3000," he says of the cult Lowland distillery that closed in 1993. Though rescued by IMD in 2017 and rebuilt, stocks of the original whisky are incredibly rare.

Contrary to the IWSR, he sees a shift to the middle with "quite good sales for our 15 year-old malts. And we are excited to be introducing a new core expression in January at what is a very affordable price for Tamdhu - £55 for the Quatro Riserva 12 year-old."

Meanwhile, people are flying again as never before. Last week, Paxsmart, a specialist GTR data provider, predicted international passenger numbers will hit 2.05 billion this year, up 8% on 2024 and 13% on 2019. However, per-capita spend among passengers has fallen.

And "you've got to look at it from a category perspective," says William. "Tequila is growing quickly and space has been given to it from other categories. There is also increasing space given to price discounts and bundle deals that takes away space from standard brands."

Clarisse Daniels, Whyte & Mackay's regional director for GTR (Europe, Middle East, India and Americas) agrees about increased discounting, but says: "I always remind my customers – 'remember who's paying the bill and everyone's salaries' – it is Scotch which remains the number one category by far. Tequila is growing, but it's just 3% of the value." She adds that depletions in GTR at Whyte & Mackay which owns Dalmore, Jura, Fettercairn and Tamnavulin, were up 14% in the year to September, and by 17% in Asia.

These are impressive results, given that Scotch shrank by a quarter (24.3%) in the 12 months to July 2025 in Asian travel retail according to a report in the Spirits Business. As she says: "There's been a huge slow-down in China, and some people are talking of a recession."

Clarisse also suggests the big publicly-quoted distillers have tended to push in a lot of stock at the end of the year to hit their targets. The geo-political uncertainty in China has impacted the spend, and, as she says: “people are not splashing out on that expensive bottle of Scotch like they used to.”

"We are seeing some exciting green shoots coming from India which has the biggest diaspora in the world, but the Indians will never spend like the Chinese. In September I sold my first bottle of Dalmore 40 year-old – that used to sell like hot cakes in China," she says wistfully.

In the country's two biggest airports of Delhi and Mumbai, single malts are now the biggest category, outselling cosmetics and other spirits, but inbound Indian passengers are denied the most expensive whiskies by law. There is US$500 limit on spending.

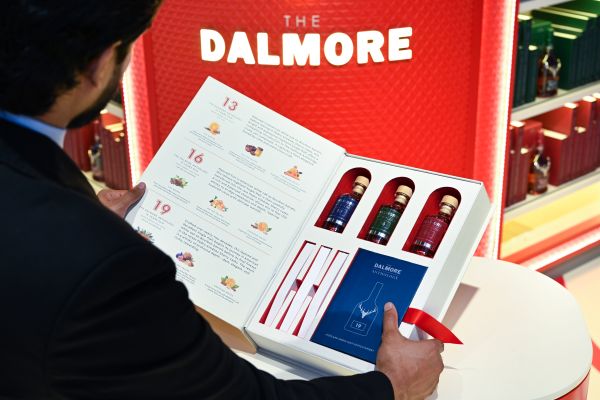

Drop down a level, and there is some evidence of trading up. In Dalmore's new GTR exclusive range, the 19 year-old at US$350 outsold the 16YO (US$165) which did the same to the 13YO (US$80) when trialled in Dubai recently.

Continuous innovation is considered crucial, and this August Diageo ran a big pop-up event for its new Johnnie Walker Black Ruby whisky at Paris Charles de Gaulle airport. Johnnie Walker, the channel's top-selling spirits brand, was hit hard by the Asia-Pacific slump in GTR which was blamed with the US and Greater China for its 5% drop in net sales in Diageo's latest FY26 results.

Andrew Cowan, its MD for GTR, won't comment on regional performance, but he explains how the channel's importance goes far beyond sales. It "acts as a shop window for our brands, with consumers in a different mindset, captive, shopping with a different lens to the ordinary," he says, [and] "it provides the opportunity to engage and excite consumers about Scotch and spirits in a different way."

"Travel retail gives you incredible visibility," adds William Ovens. "You've got 80 million people going through Heathrow, and it's similar in Dubai." He quotes research that "proves people very often see brands for the first time in GTR, buy them for the first time there, and then repurchase in the domestic market."

To end on a note of optimism; while duty-free Scotch was flat in volume and down -4% in value from 2019-24 on a CAGR basis, the IWSR forecast it will grow 3% year on year in volume and value for the next decade.

.jpg)

Award-winning drinks columnist and author Tom Bruce-Gardyne began his career in the wine trade, managing exports for a major Sicilian producer. Now freelance for 20 years, Tom has been a weekly columnist for The Herald and his books include The Scotch Whisky Book and most recently Scotch Whisky Treasures.

You can read more comment and analysis on the Scotch whisky industry by clicking on Whisky News.