Under the Hammer

The secondary market for Scotch has collapsed from its recent peak in both volume and value. It is a parallel universe to the primary business of distillers, and yet it still exerts a certain influence, particularly on pricing, reports Tom Bruce-Gardyne …

The Friday before last, a 60 year-old Glenlivet in a hand-blown, spiral decanter went under the hammer at the Distillers One of One charity auction at Hopetown House near Edinburgh. A flurry of bids took the price way past the high estimate of £110,000 to reach a dizzying £650,000 – just one of thirty records broken that day.

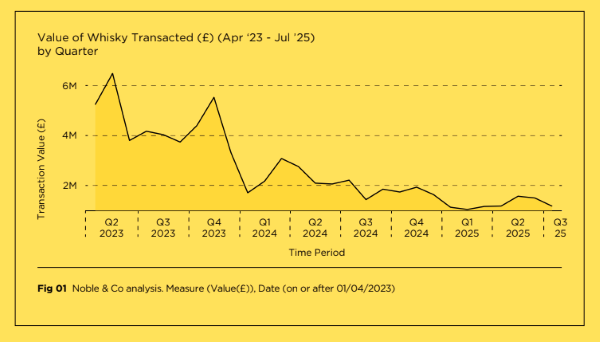

While demand for the rarest of the rare among Scotch whiskies remains buoyant, the overall secondary market for the drink is anything but. Indeed, auction sales by volume and value have basically collapsed in the last couple of years reckons Duncan McFadzean, CEO of Noble & Co which publishes a quarterly Whisky Intelligence Report.

The Q3 Report, the last in the series, has just come out. Duncan describes the collapse as "macro-driven, and it has been the same for jewellery, watches and art. Post quantitative easing, a lot of these alternative investments became less appealing as people retreated back into different asset classes."

"That took a lot of the liquidity out of the market. Compounded by that, you have had all the noise and substance around cask mis-selling though brokers," he says, referring to the BBC's documentary in March - 'Hunting the Whisky Bandits'. "I don't think that helped, but I don't think it's been the primary driver."

The twelve Whisky Reports compiled by Noble & Co have provided a detailed snapshot of what is going on at auction – the prices paid, and the brands and regions that are leading the charge. No prizes for guessing which name crops up the most.

"Macallan as a brand, as opposed to the company, is obviously quite a significant part of the secondary market," Duncan explains, "Therefore, the company is interested in what's happening in that market, even if they are not economically benefitting from it."

The Whisky Intelligence reports have all been commissioned by Macallan in order to gain commentary, research and data, but the company has no editorial input. As to its significance – auction sales of the brand were worth over £12 million in the 18 months to July, almost four times the next biggest player – Springbank, followed by Bowmore on £2m.

In truth, the primary market for Scotch whisky has benefitted from the recent boom in the secondary market, with surging prices in the latter pushing up prices in the former. "For the last few years, the industry felt it had pricing power for the first time in a long, long time, and took advantage of that to drive prices up," says Duncan. "If your products are selling at £1,000 at auction, then suddenly adding £5, £10 or £15 onto the retail price doesn't sound extreme."

Not so long ago, the industry was happily selling off the family silver on the cheap. In 2007 Diageo's 'special release' from its then closed distillery of Port Ellen was priced at just £140, but within weeks bottles were being flipped for double that amount. Subsequent release prices rose dramatically to close the gap, hitting £2,200 in 2014.

In Duncan's words the distillers "woke up to what collectors were prepared to pay. I think that got extreme two or three years ago when there was such investment capital in there as well, and maybe valuations got ahead of what was sustainable."

There is clearly a risk of over-anticipating demand in the secondary market which is volatile and speculative by nature. As Geoff Kirk, head of the prestige channel at The Macallan said in 2024: "In my opinion, if any brand was to get ahead of that, it risks killing the goose that lays the golden egg." Some would say, that's pretty much what happened.

Duncan mentions another aspect of the boom: "I think it made [distillers] release an awful lot of limited, special editions and collector sets. That has reversed in the last twelve months, quite sharply."

However, he has no wish to pass judgement on pricing. "If you're selling a million bottles a year, why shouldn't you be able to sell 500 bottles at £10,000 and make a very high margin?" he asks.

As a business model "it can enable you to run a much lower margin volume business alongside it," he adds, while admitting "there are not many [distillers] who do that really well. It tends to be one or the other."

But what of the drinks writer Dave Broom's assertion that "whisky is not inherently a luxury product"? Duncan is not convinced by that, and says: "If you think of handbags, scarves and cars, all of which at their basic level are manufactured goods with a utility purpose, however there are companies that have crafted luxury aspects of that."

At the extreme, super-rare, end of the spectrum, he points to the latest One of One auction as proof that whisky can play in that space too. "I think most whisky will always be for drinking, but there is a component of it that can be luxury, and about the experience, and some people are doing that really well."

And yet he accepts that the dazzling prices at the top-end has been quite a distraction for many. "I think people got obsessed with ultra-high net worth consumers in China who were going to give them £500,000 a year of whisky purchases," he says. "That made them so much money they forgot the supermarket in Italy that could order 20,000 bottles for a 10% margin."

As the wealthy Chinese evaporated, he says: "I think the industry is pivoting back very, very quickly to focus on volume. Some distillers have told me that stuff over £50 isn't really selling while under £50 is, so, that's where they're focusing on, and that's where they're launching products."

Award-winning drinks columnist and author Tom Bruce-Gardyne began his career in the wine trade, managing exports for a major Sicilian producer. Now freelance for 20 years, Tom has been a weekly columnist for The Herald and his books include The Scotch Whisky Book and most recently Scotch Whisky Treasures.

You can read more comment and analysis on the Scotch whisky industry by clicking on Whisky News.